OVERVIEW

There is perpetual threat possibility for organizations in this digital age. Assessing the risk exposure of other businesses can be incredibly challenging, especially with traditional methods becoming outdated for underwriters and insurers.

CyberMindr provides a tailored solution for the insurance industry, offering unique, comprehensive insights into digital vulnerabilities that other tools often overlook. With real-time risk evaluations, CyberMindr helps you make informed underwriting decisions. It reduces uncertainty and improves accuracy resulting in better pricing, lower risk, and more profitable underwriting.

Why Choose us?

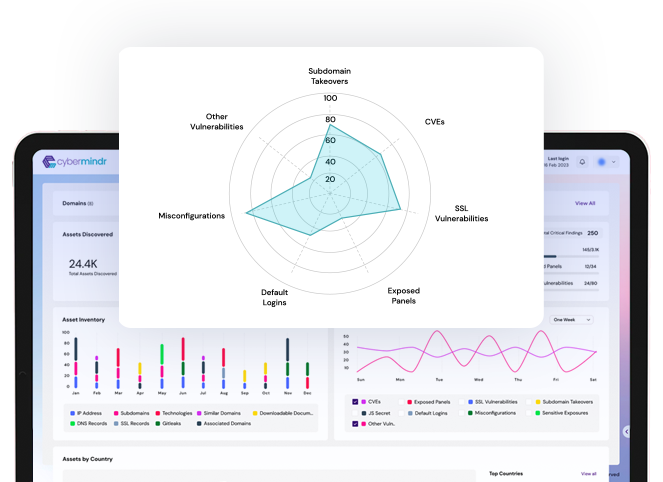

Get real-time, data-driven insights for the most accurate risk evaluations possible.

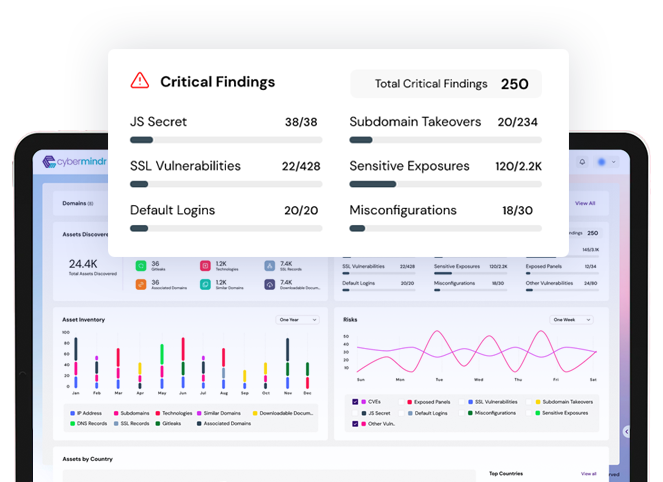

Identify undiscovered, lost and hidden assets to get a complete and accurate risk profile for clients, ensuring more informed underwriting decisions.

Get current and precise threats by incorporating the latest tactics, techniques, and procedures (TTPs) into your underwriting decisions.

Leverage validation engine to ensure your evaluations are based on reliable data without disrupting your clients’ business, providing seamless, unobtrusive assessments.

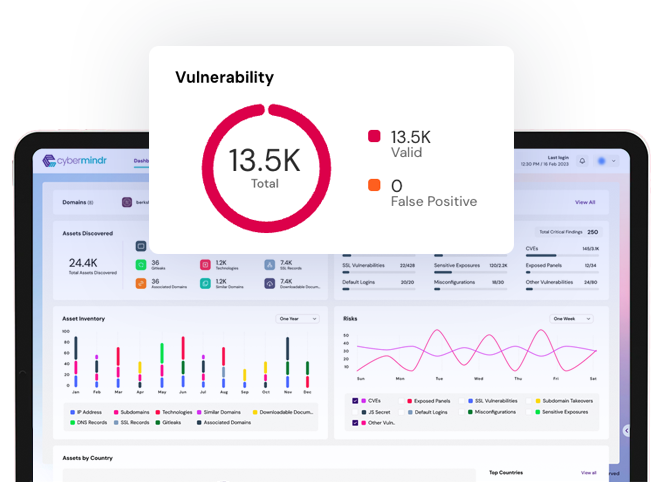

Focus on real vulnerabilities with zero false positives, providing clear and actionable risk insights for underwriting efficiency.

Provide accurate premium pricing for every client with detailed risk scoring based on comprehensive threat assessments.

Increase operational efficiency by evaluating multiple clients simultaneously while maintaining precise, comprehensive risk assessments.

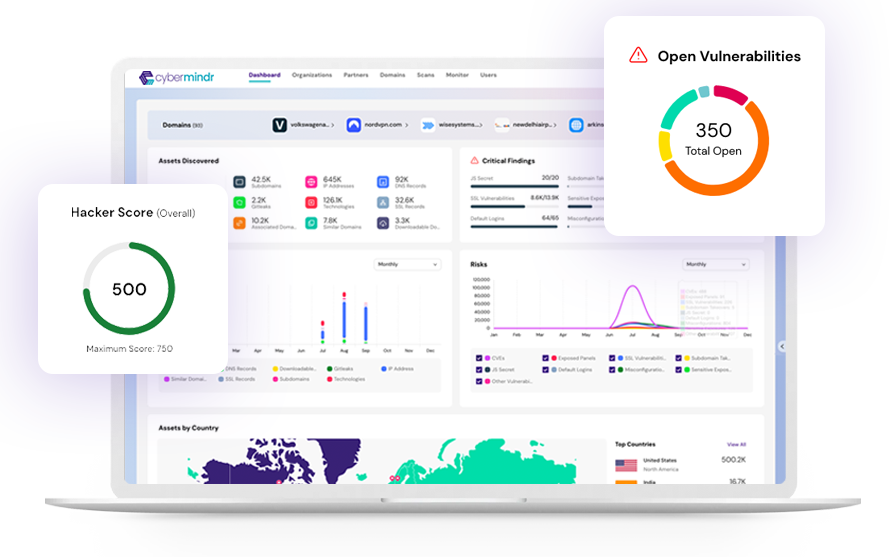

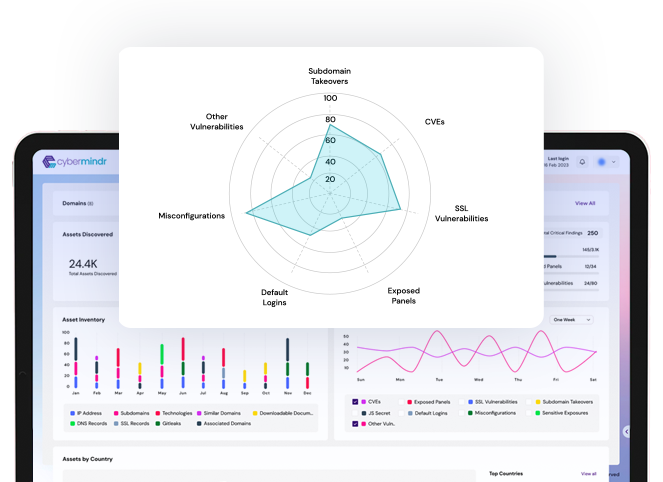

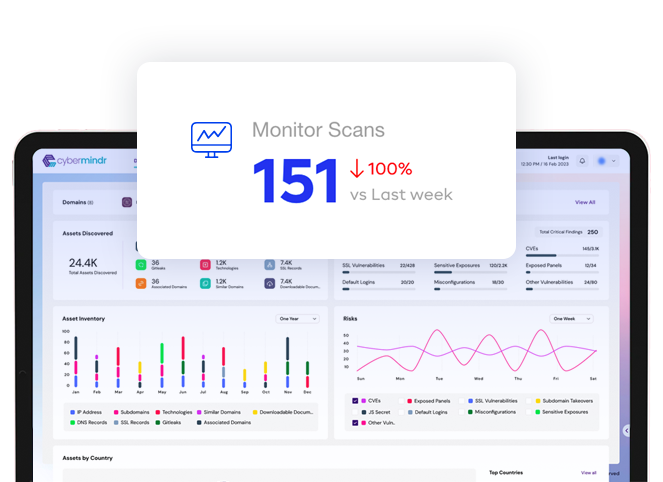

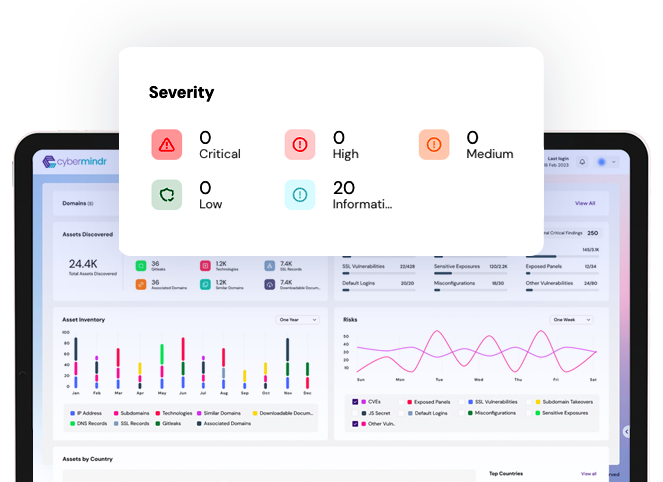

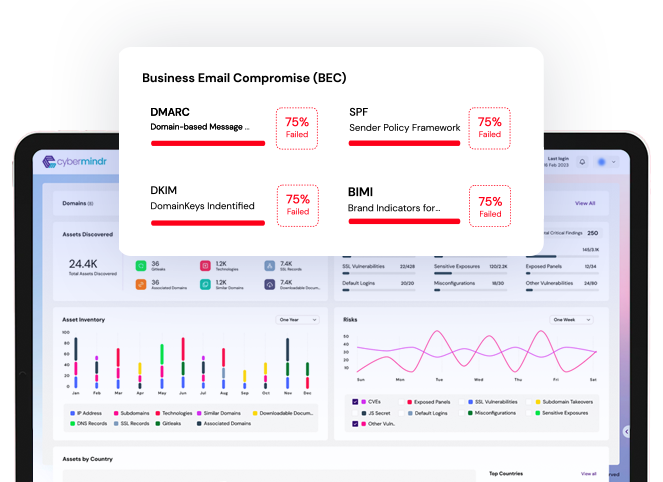

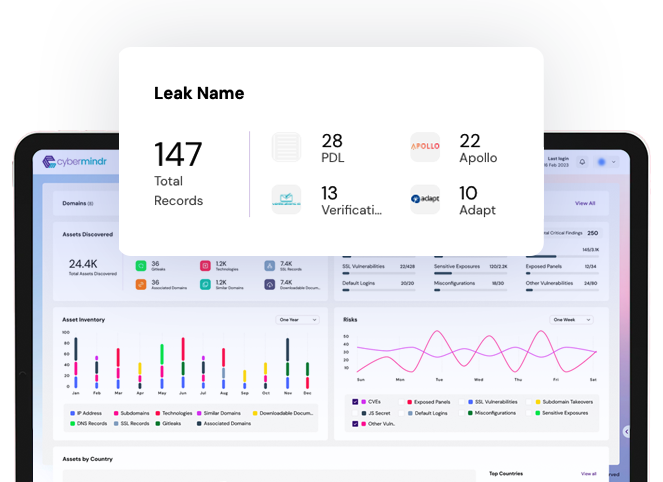

cybermindr platform

Continuously scan your internet facing assets for known and emerging vulnerabilities

Advanced testing methods looks for vulnerabilities beyond CVEs

Related Use Cases

Gain insights into the cybersecurity posture of your portfolio companies

Read more

Meet regulatory requirements, streamline audits and avoid costly fines.

Read more

Safeguard your assets by minimizing potential risks from third party technologies that your organization uses.

Read more

Conduct in-depth evaluations of potential acquisitions or partnerships.

Read more